Pension Forms

Automated calculation of NHS pension forms

PennyPerfect creates your NHS pension forms from the session details already entered. Optional contributions such as AVCs and ERRBO can be easily included. PDF files of the forms are created fully formatted and populated ready to send.

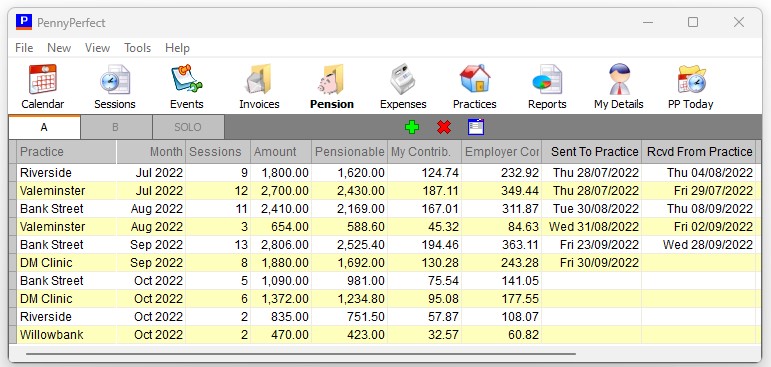

You can record when each form was sent and returned. With everything in one place, pension reports can be generated that detail your pensionable income and contributions for any period.

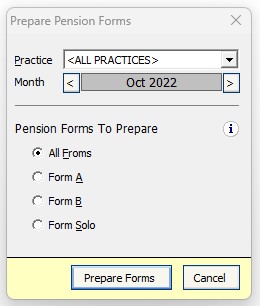

To calculate your monthly pension forms, click the green plus sign at the top of the Pensions page and the dialogue shown below is displayed. Pension forms need to be calculated on a monthly basis, but will not be created if there are no sessions that meet the criteria.

Forms A and SOLO are calculated for each Practice and LHB where sessions have been worked that month.

One form B is created for income received that month (the Form A's returned to you from the Practices).

Altering Pension Forms

If you need to alter a form, for example you get a last minute session at the end of the month after already calculating the form, just delete the form then recreate it and it will include this newly added session.

To ensure the figures remain consistent between forms you cannot change or delete any Form A which has been used to calculate a Form B. You must delete the Form B first, then recreate the Form A, then recreate the Form B which uses this Form A.

Overnight Sessions

If a session is overnight so its on two different months ie from 31 July to 1 August, the session will appear on the pension forms for July - all calculations are done on the start date of the session.

Pension legislation and pension scheme rules are complex and subject to change. PennyPerfect make no claim the information represented here is correct, or that the pension calculations within the PennyPerfect software are correct.