Expenses

Recording expenses not invoiced

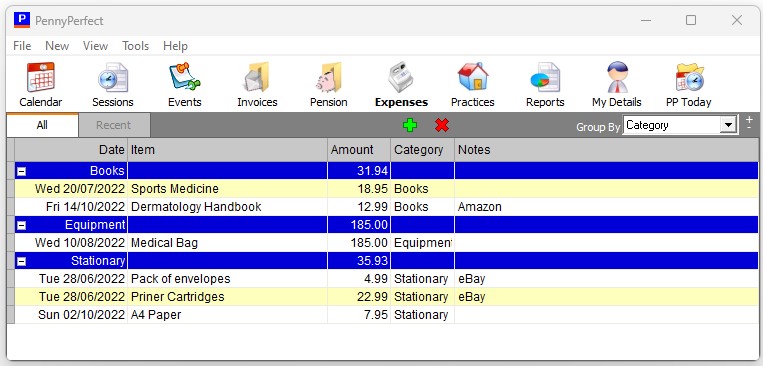

PennyPerfect allows the recording of expenses which cannot be invoiced to Practices, for example training courses, subscriptions, and fees for professional bodies. Some of these may be tax deductible.

The categories against which items can be recorded are entirely user defineable. Just type in the name of a category against an item (or leave it blank), and this will be used when the grid is grouped.

To view the total expenses for a particular period e.g. tax year, there is an expenses option on the Reports screen.

Repeating Expenses

When entering expenses, you can specify that they recur on particular days or dates, weekly or monthly, for a set number of recurrences or until a set data. This allows the simple entry of repeating expenses such as subscriptions, monthly memberships etc.

Not all expenses are tax deductible for income tax purposes. The treatment of capital and revenue expenses against income tax for self-employed doctors must be in accordance with current UK taxation law and professional advice should be sought where necessary.