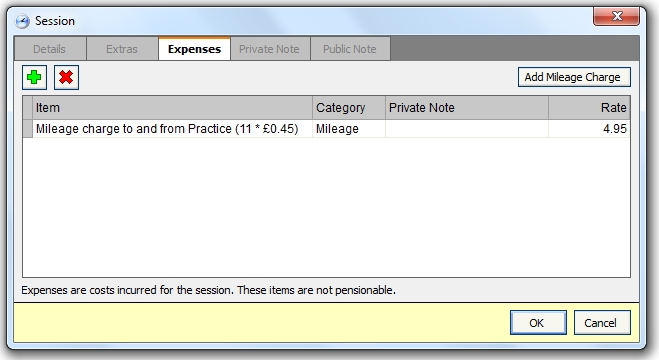

Session Expenses

Charge expenses for each session

If you incur business expenses during a Session which you wish to charge for, you can add expenses on top of your normal session rate. A session can have any number of expenses.

All of the expenses from each session will appear on the invoice, but they are not included as pensionable income in the calculations for pension payments.

Not all expenses are tax deductible for income tax purposes. The treatment of capital and revenue expenses against income tax for self-employed doctors must be in accordance with current UK taxation law and professional advice should be sought where necessary.