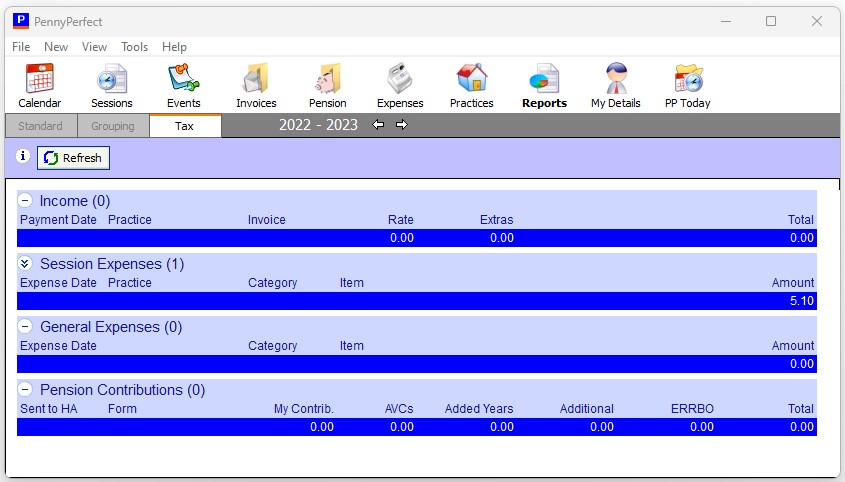

Tax Report

Self Assessment made easy

The Tax report collates your income, expense, and pension contribution data required for a self assessment tax form. The data is displayed summarised, and can be expanded to see how each section has been calculated.

Income

The income figure is calculated based on the day you received payment of invoices. It is the total of the Session Rate and Extras (Session Expenses and Employers Pension Contributions are not counted as income).

Session Expenses

Session expenses are calculated based on the start date of the session.

General Expenses

General expenses are calculated based on the expense date - the day the expense was incurred.

Pension Contributions

These are calculated based on the day the payment was sent to the pension provider (the "Sent to HA" date on the Form B and Form SOLO). It includes your contribution, added years, additional voluntary contributions (AVC's), addiitonal payments, and ERRBO. It does not include employer contributions.