Employer Pension Contribution

Employer Pension Contribution in England and Wales

The employer pension contributions are paid by the employer to the locum. The locum must invoice the employer for these then pass these employer contributions along with their own contributions to the pension provider.

The employer pension contribution is only included on a Session and therefore on the pension forms if session type is "NHS Normal" or "NHS OOH".

Employer Contribution Rate Changes

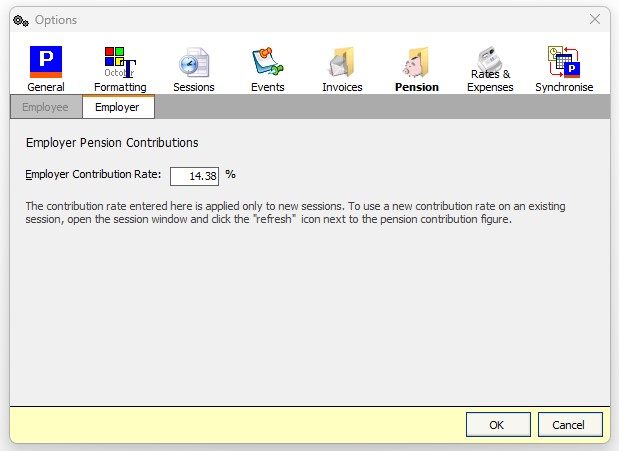

The employer pension contribution rate can be changed on the Options screen on the Pension tab.

This new rate is only used for new sessions and forms created. If this new rate is to be used for sessions that have already been created the session needs to be edited to force a recalculation of the pension contribution. This is explained in more detail on this page.

Pension legislation and pension scheme rules are complex and subject to change. PennyPerfect make no claim the information represented here is correct, or that the pension calculations within the PennyPerfect software are correct.