Employee Pension Contribution

Change your contributions depending on your income

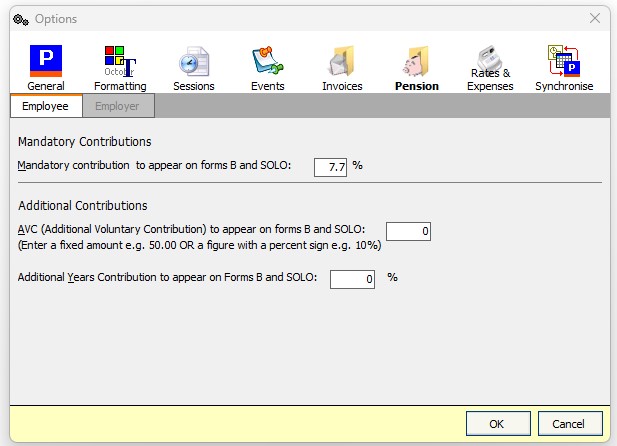

The employee pension contribution rate depends on the annual income of the employee. You can change the rate in PennyPerfect by selecting the Pensions tab on the Options screen.

After changing a contribution rate any existing sessions which are to use the new rate need to be edited to force a recalculation of the contribution amount using the new rate. This can be done by editing the session and clicking the 'Refresh' icon next to the 'Employer Pension Contribution' box.

Additional information

More details about the NHS pension schemes can be found on the NHS pension website.

Pension legislation and pension scheme rules are complex and subject to change. PennyPerfect make no claim the information represented here is correct, or that the pension calculations within the PennyPerfect software are correct.